7 Excellent Rewards Credit Cards of 2022

Chase Freedom Unlimited®

1. You can Earn an additional 1.5% cash back on every times when you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back easily you can Win !

2. On travel purchased Enjoy up-to 6.5% cash back through Chase Ultimate Rewards®, its premier rewards program that lets you redeem rewards for cash back, ravelling, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

3. when After your first year or $20,000 spent, enjoy 5% cash back on Chase travel purchased items through Ultimate Rewards®,dining at restaurants 3% cash back and on drugstore purchases, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

4. No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 17.99% – 26.74%.

5. No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

Main points

No annual charges and free

Intro APR period Grace periods offers

High rewards rate amoung all

No minimum redemption amount caping

Remember thats

Requires good/excellent credit

Apply From Here Click here

Capital One SavorOne Cash Rewards Credit Card

Excellent for

Dining and Groceries + No Annual Fee

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. - No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn

- 0% intro APR on purchases and balance transfers for 15 months; 17.99% – 27.99% variable APR after that; 3% fee on the amounts transferred within the first 15 months

No foreign transaction fee

No annual fee

Wells Fargo Active Cash® Card

Excellent for

Cash Back — High Flat Rate + Incentives

- Earn a $200 cash rewards bonus after spending $1,000 in purchases in the first 3 months

- Earn unlimited 2% cash rewards on purchases

- 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers, then a 18.74%, 23.74%, or 28.74% variable APR; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5

- $0 annual fee

- No categories to track or remember and cash rewards don’t expire as long as your account remains open

Enjoy a premium collection of benefits at a selection of the world’s most intriguing and prestigious hotel properties with Visa Signature Concierge - Get up to $600 of cell phone protection against damage or theft when you pay your monthly cell phone bill with your eligible Wells Fargo card. (subject to a $25 deductible).

Capital One Venture Rewards Credit Card

Chase Freedom Unlimited®

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Ultimate Rewards®.

- Enjoy benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining and 2x on all other travel purchases, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 60,000 points are worth $750 toward travel.

- With Pay Yourself Back℠, your points are worth 25% more during the current offer when you redeem them for statement credits against existing purchases in select, rotating categories

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

Apply from here Click here

Chase Sapphire Preferred® Card

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Ultimate Rewards®.

- Enjoy benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining and 2x on all other travel purchases, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 60,000 points are worth $750 toward travel.

- With Pay Yourself Back℠, your points are worth 25% more during the current offer when you redeem them for statement credits against existing purchases in select, rotating categories

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

Apply from here Click Here

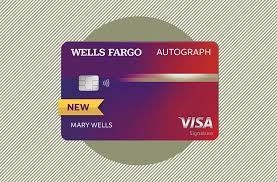

Wells Fargo Autograph℠ Card – Offer Ending Soon

- 0% intro APR for 18 months from account opening on purchases and qualifying balance transfers. Intro APR extension for 3 months with on-time minimum payments during the intro period. 16.74% to 28.74% Variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min $5.

- $0 Annual Fee

- Get up to $600 of cell phone protection against damage or theft when you pay your monthly cell phone bill with your eligible Wells Fargo card (subject to a $25 deductible).

- Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants. It’s an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card.

- Unlimited Cashback Match – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places each quarter like Amazon.com, grocery stores, restaurants, and gas stations, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases – automatically.

- Discover helps remove your personal information from select people-search websites. Activate by mobile app for free.

- Every $1 you earn in cash back is $1 you can redeem.

- Get a 0% intro APR for 15 months on purchases. Then 14.99% to 25.99% Standard Variable Purchase APR applies, based on credit worthiness.

Get More Info From Here >>>>>Cick here

See Our more Posts click here